The Balance of Power

Donald Hill analyses the overall situation in Ukrainian and Russian Armed Forces and their mid-term Outlooks

Because its ability to sustain production is limited, the entire Russian war effort is ‘on a clock’.

When, sometimes towards the end of 2025, the Russian armed forces run out of combat vehicles left over from the (First) Cold War and still in storage, the Russia’s ability to produce and/or refurbish will be reduced by two thirds - or even more. Moreover, the head of the Russian Central Bank said that the country’s economy cannot maintain stability at these levels indefinitely.

Certainly enough, there is (still) no sign of meaningful mass public resistance to the regime, but each month Russia feeds 15-30,000 men into Ukraine. These people are removed from an economy that was already short of 5 million laborers back in December. And Ukrainian drones are starting to attack the Russian means of production. As the Ukrainian capabilities develop, the impact of these attacks could range from ‘minimal’ to ‘massive’.

On the other side of the ledger, Ukraine and its (serious) allies are steadily increasing ammunition production. The Czech and Estonian procurement of artillery shells on the world market should be enough to sustain Ukrainian defensive efforts for a year - once these start arriving, in June. One should keep in mind that the ammunition in question is ‘separate’ from anything European allies might deliver.

Production of the French Caesar and the Ukrainian Bohdana self-propelled artillery systems will soon exceed the Ukrainian rate of loss in artillery: the range and accuracy of these systems are already making them more effective than systems that are decades older.

Allied production of tanks and infantry fighting vechicles is low (to put it mildly), and - while Ukrainian vehicular losses are low - they are still higher than the production rates. Some of this is going to be replaced by hundreds of Soviet-era armoured fighting vehicles Ukraine is likely to receive from Poland - once that country replaces them with vehicles from Korea or licence production at home.

That said, this is all still ‘future’.

Right now, the biggest threat to Ukraine are the missile- and drone attacks on its critical infrastructure, casualties to a limited manpower pool, to its increasing arms and ammunition production, and the deployment of Russian glide bombs. Indeed, right now, the Russians are intensifying their offensive operations - obviously aiming to exploit both their momentum and the fact that Ukrainian air defences are inadequate.

The fighting in Avdiivka during October was intense and Russia lost a lot of equipment concentrated in one area. The fighting in Terny, Chasiv Yar, west of Avdiivka and in the Novomykhailivka are is - ‘collectively’ - more intense and this is reflected in Russia’s higher rate of loss in equipment in the last two months. Russian personnel losses have been high since October (some 100-200 more men per day than at the height of the Russian prisoner wave attacks during Bakhmut (and Vuhledar) attacks): this is, gradually, decreasing Ukraine’s ‘window of vulnerability’ due to shortages in air defences and artillery.

Russia is increasing offensive operations because Ukrainian air defenses are inadequate, Ukraine’s window of vulnerability due to artillery shortages is closing, and Russia has 18-24 months left of vehicular offensive combat capability.

The current cycle shows that Russia launches constant aerial and artillery bombardments, followed by mechanized and dismounted attacks until they run out of ammo, equipment and personnel. Then they take a few days to replace and re-equip and launch a new round of attacks. They are slowly taking ground, and Syrsky says that the situation is critical for Ukraine’s defenses in some areas. There’s no sign of Russian attacks ending anytime soon so it’s a question of how much Russia can take before their war machine comes to a halt, and how much will they lose while taking it. Currently, the country has some 18-24 months left in terms of ‘vehicular offensive combat capability’.

Then - and provided Ukraine can stockpile enough ammunition and improve its air defenses - it will be the turn on the ZSU to go on the offensive.

The clock is ticking.

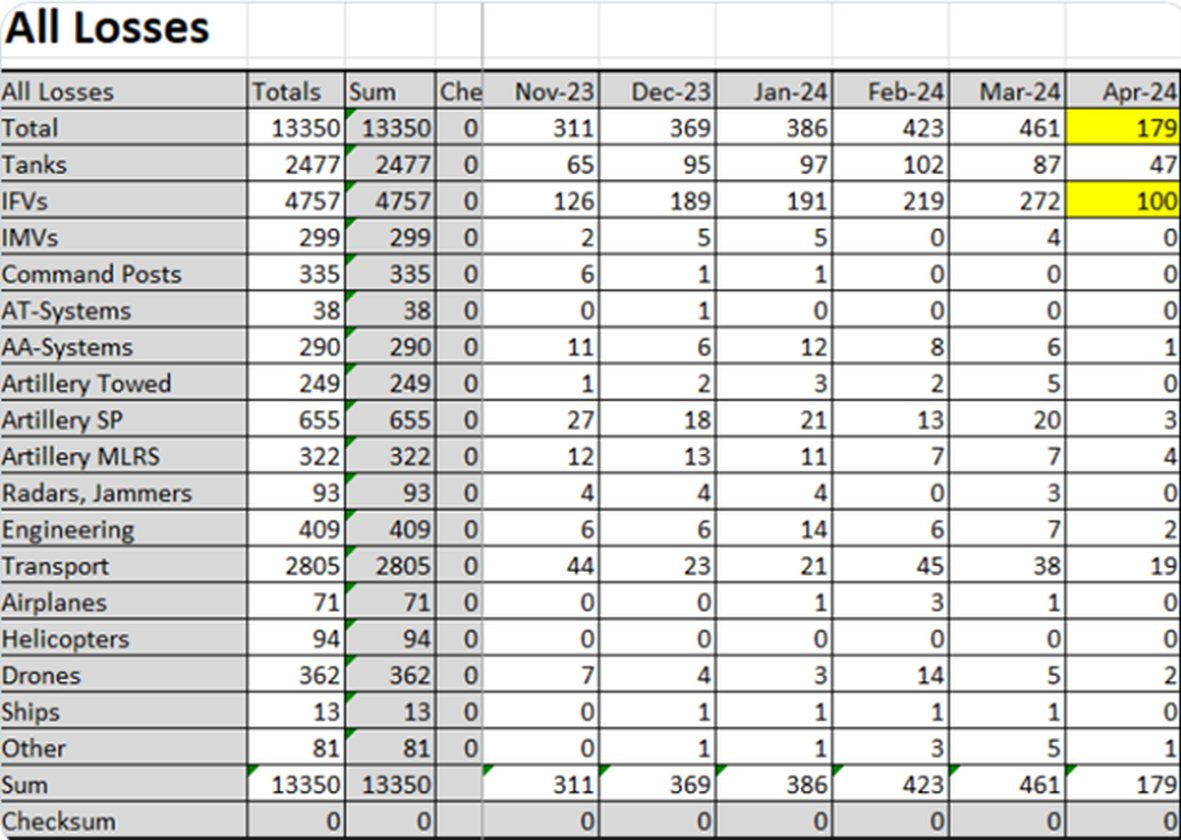

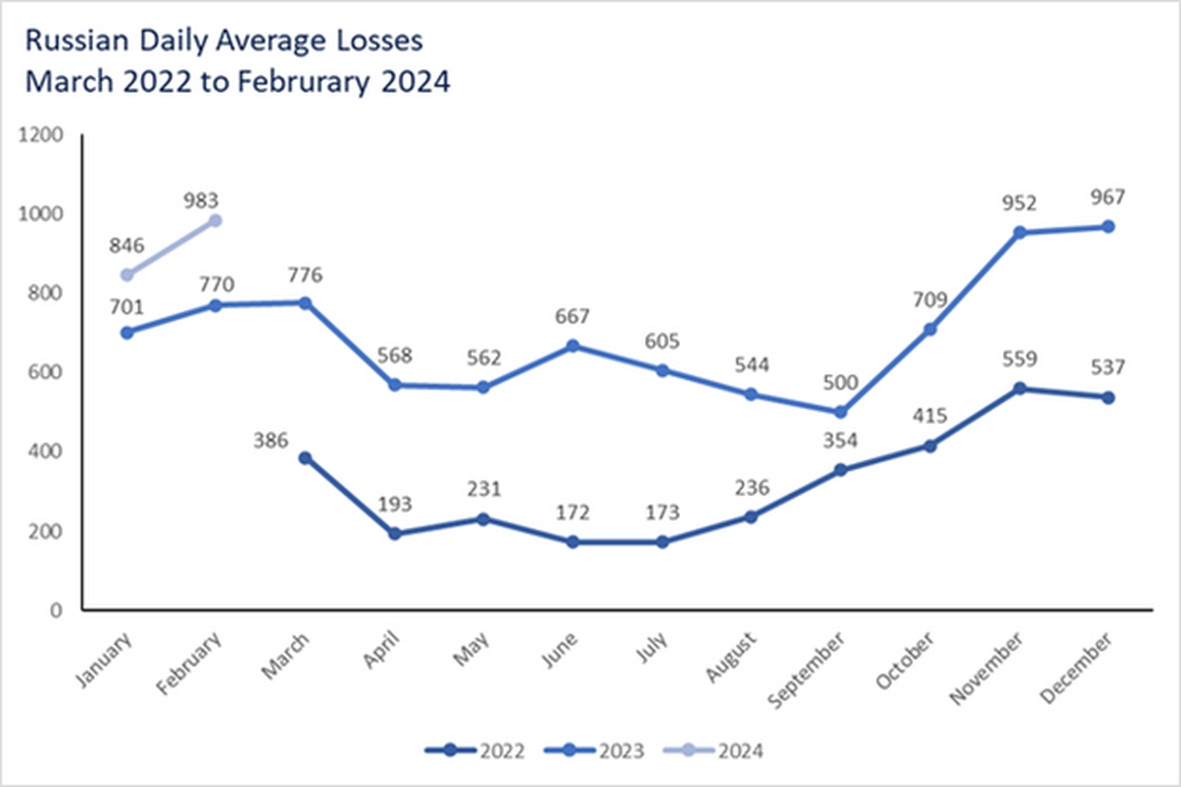

The following two charts were compiled by Andrew Perpetua.

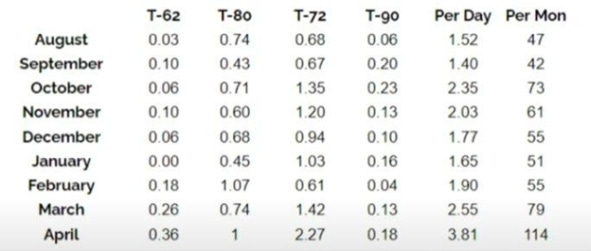

Warspotting says that 100 Russian BMPs and 47 Russian tanks were destroyed in ten days during April. If the loss rate remains the same, you’d triple these numbers for a monthly total. The loss of all equipment tracked here has steadily increased since November… https://twitter.com/verekerrichard1/status/1779064427221852542

The three different lines on the following diagram represent the average daily losses in each month, by year: 2022 is on the bottom and average daily losses (by month) never exceed 559. 2023 is represented by the line in the middle and the average daily losses ranged from 500 to 776 up until October. From November 2023 to February 2024, the losses jumped to 846 and higher. The UK says that the daily Russian personnel losses in March dropped to 913.

BTRs are out of production for decades and nearly all currently still in service have been removed from storage. Therefore, their numbers are declining due to attrition…

https://twitter.com/verekerrichard1/status/1778525756882354214

Based on his analysis, Andew Perpetua lists causes for tank destruction. One thing he observed on his weekly YouTube-appearance is that his Ukrainian artillery contact told him they are ‘encouraged not to share the kills by artillery’…

https://twitter.com/AndrewPerpetua/status/1778604406067302903

Thanks Don!

Yet, I wouldn’t count on Russian weapons to end first.Ukraine just got 80 quite old BTRs or BMPs from an Eastern country - Bulgaria. Now you tell me how much are rusting in North Korea - probably thousands and I’m sure that for the right price Kim will let them go. At some point China will also offer theirs if the situation becomes critical. The only finite resource is the people in Russia. The population is not so big to sustain a disproportionate loss to the Ukrainian casualties. The attacks on refineries if sustained and expanded were promising but now Russia has probably strengthened its air defenses around them. Yet, there are a limited number of steel plants, LNG export terminals, rubber and tire facilities - and destruction of them will help. But a drone with 20kg of explosives can only inflict quite a limited damage…

I would be careful with Perpetua's figures (including Ukrainian losses), as his team's standards for inclusion seem to be concerningly-low compared to the other two or three major pro-UA trackers.

My own calculations have consistently shown something like late 2026 as a deadline period for the Russian military's offensive capacity. Even the relatively-steep equipment losses taken over the past half-year are really comparable to the 2022 spring offensive or the 2023 winter campaign. So add at least 6 months to the 18-24 month projection.

Those figures on personnel losses are not realistic unless all wounded are included - but then, most wounded are not losses.

Regarding BTRs, they are still in production. According to this TopWar article from 2021, 40-50% of BTR-82 were new-build. New builds delivered in 2020 were 130. It is near-certain that new IFVs in 2024 (BMP-3, BTR-82, BMD-4) will reach at least 500, but possibly many more.

https://topwar.ru/180450-rezultaty-proizvodstva-btr-82am.html