(…continued from Part 3…)

***

Equipment

The Wild Hornets installed an automatic assault rifle on their drone.

Perpetua said Russia flies 300 reconnaissance drones a day and that their doctrine is to have 8 drones in their inventory for every drone they fly, which suggests they should have a minimum of 2,500 drones in operational service at any time. A Ukrainian FPV interceptor gives us a close look at this Zala Lancet drone with four wings, called the Izdeliye 51. Somewhere on the front, Russians acquire the video feed of the Ukrainian interceptors and watch as they close in and destroy a Russian reconnaissance drone.

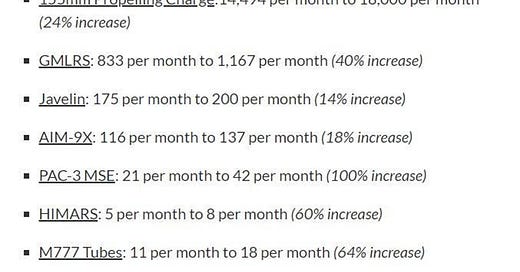

These are the current US production rates. Plans to increase production in other countries are also listed here. By the end of 2026, the US plans to build 330 Javelins per month.

As Russia consumes its stored vehicles, only those in poor condition remain.

Germany delivered some of the Gepards it bought back from Jordan. Germans also restarted the ammo production line for these weapons.

Ukraine is using the PFM-1 anti-personnel mine to counter Russia’s increased used of motorcycles. The results can be seen here.

After watching videos this week, Perpetua noticed that 50% of Russian MRL shells are duds.

A reminder from earlier posts: The US will finish production on another 100 Bradleys by January. In the meantime, some unspecified number of Bradleys are on their way to Ukraine. The last shipment of Bradleys to Ukraine covered their losses to that date, plus a few more. Most of the stored Bradleys are being converted into replacements for the M113 support vehicles (Medevacs, mortar carriers, command vehicles, etc.). Ukraine’s future is the 1000 CV-90s they will receive over the next 2-10 years. It takes two years to build a CV-90 once capacity is established. Ukraine is building a factory as part of a joint venture with Sweden.

***

Secondary Sanctions and Foreign Currency Reserves

Armies can be defeated by the destruction of men and equipment on the battlefield, by the destruction of factories producing equipment, or by the destruction of the economy that enables the factories to function.

After Russia’s open invasion, the dollars and euros they had in banks were frozen and they could not conduct any further trade in those currencies. Chinese and Indian trading partners would not accept the unstable Russian ruble so the Chinese yuan became the dominant currency of trade for Russia.

In the spring of 2023, China bought 3,000 sights for tanks and sent them to Belarus. Russian tanks with these sights rolled off the production line in May 2024. In February 2024, a Chinese company acquired precision parts in Japan and sent them to Belarus, who then supplied them to Russia. Dual-use products can be used for both civilian and military purposes, and 90% of the dual-use products Russia received came from China (chart in article). With all the Chinese trade helping the Russian economy and military production, the US announced in May that it was considering sanctioning Chinese financial institutions facilitating these trades.

While Russia is the primary country being sanctioned, anyone helping Russia evade those sanctions could be hit with secondary sanctions. The US made it clear that if Chinese banks continued to facilitate Russian trade with the yuan, those banks would be excluded from the SWIFT system, which allows countries to efficiently and securely trade with dollars. (Trade could still happen, but more slowly and with the possibility of human error, creating a competitive disadvantage). China, and other nations, had to choose between doing business with Russia (where there was profit to be made), or doing business with the rest of the world using dollars. The dollar is such a dominant world trade mechanism that many companies are forgoing potential profit in Russia in favor of the much more lucrative world market.

(Half the world’s transactions are conducted with dollars. If the US overplays its ability to manipulate the use of the dollar in order to achieve policy goals, it could drive countries to other currencies to avoid the impact of sanctions. But if these countries chose to use the yuan, then they would give China the same potential impact on world policy. Chinese sanctions have increased since 2018, and were used to target individuals and entities that “interfered” with what it calls “internal affairs”, such as Xinjiang (where most Uyghurs live), Hong Kong and Taiwan).

Actually imposing widespread sanctions on Chinese institutions could upset the world markets since China is the world’s largest exporter. ($3.5 trillion compared to $3 trillion for the US). Continually threatening to impose sanctions without actually doing so could lessen the impact of the threats.

But the threat of secondary sanctions did have an effect. Specific threat by the US in December resulted in a large reduction of trade between Russia and Turkey. Major Chinese commercial banks refused to accept yuan payments from Russia. In April, Russia admitted having trouble paying for computers and electronic storage systems. The 2014 sanctions against Russia meant they could no longer use Visa or Mastercard, so the Russian central bank created the Mir card in 2017, and Kyrgyzstan and Kazakhstan stopped using the Mir card system in 2024.

Still, smaller Chinese banks with less exposure to the international financial system continued to do business with Russia. Sanctioning them would have little effect since they don’t use the system from which they would be excluded. And solutions were found to evade the secondary sanctions, such as buying gold, moving it to Hong Kong to sell it and depositing the cash from the sale into a local bank account. There are logistical limits to actually moving the 300 metric tons of gold that Russia still has.

They also used intermediaries in third countries to handle the transactions, but these solutions added three weeks to payment times, and added 6% costs for the intermediary transactions. Trading volumes fell dramatically. And not everyone found an immediate solution. By August, billions of yuan were stuck in limbo while the Russians were searching for an exchange mechanism. Those smaller Chinese banks that could not be impacted by secondary sanctions have outdated IT systems and a staff that lacks the necessary skills to handle the volume of business needed.

In 2021, the yuan was used as payment in 0.4% of all Russian export transactions. In May 2024, 53.6% of Russia’s foreign exchange trading was conducted with the yuan. By July, 99.6% of the exchange trading used the yuan. With such a high demand for the yuan in Russia, and fewer sources to obtain them, the supplies of yuan in Russia dried up and the rouble fell against the yuan by 5%, making it more expensive to buy yuan. The Russian central bank had been selling $7.3 billion worth of yuan each day but future projections indicate that it will only be able to sell $200 million worth of yuan a day.

What this means is that it will be increasingly difficult for Russia to pay for anything it buys from another country, and it will be increasingly difficult for countries to pay for Russian oil and gas. On top of that, everything Russia buys will be more expensive.

These factors are significant pressures on the Russian economy which is already burdened by a shrinking workforce, high inflation, and dwindling foreign currency reserves (now at half the 2022 levels). Add to that, Ukrainian strategic bombing with drones and missiles are increasing their impact on oil, gas and electricity production. Russian trains are operating at full capacity and can only meet 93% of the demand for transportation. Any Ukrainian attacks on the Russian rail system will have an immediate impact on Russia’s ability to move goods, even if only a fraction of a percent. Russian remedies to these pressures led eight European finance ministers to say the Russian economy is returning to the Soviet model.

Ben discusses Russia’s wartime economy. Military personnel costs are leveling off with a 25% increase this year compared to a 120% increase in 2023. Military equipment costs are rising at the same rate (54% this year compared to 47% last year), reflecting that more tanks have to be built from scratch rather than being refurbished from storage.

The economy is being funded by the cash reserves, which increases inflation, which leads to another round of interest rate hikes to combat inflation, which makes it harder to borrow money, which is necessary for economic growth. Eventually, the cash reserves will run out. It took 2.5 years to deplete half the Russian reserves. Russia withdrew $37 billion to cover deficits in December 2022. It withdrew $20 billion to cover deficits in December 2023. It only has $54 billion left.

With the pressure of the secondary sanctions the rate of depletion will increase. If the price of oil or gold drops, it will severely impact Russian reserves. If the price of oil or gold increases, it will buy Russia more time. When the reserves are gone, Russia will either transition to an inefficient command economy coupled with levels of corruption not seen in the Soviet era, or simply collapse.

A failure of the Russian economy has the potential to change the war in a way that the fighting on the ground cannot.

Thank you for this part. I have to re-read the part of China and the economic impacts. Tonight in the metro I will have more time. Best wishes from Paris.

Just one correction- Soviet corruption was never as bad as post Soviet corruption in 1990s.